Private label doubles down on continued growth in 2024

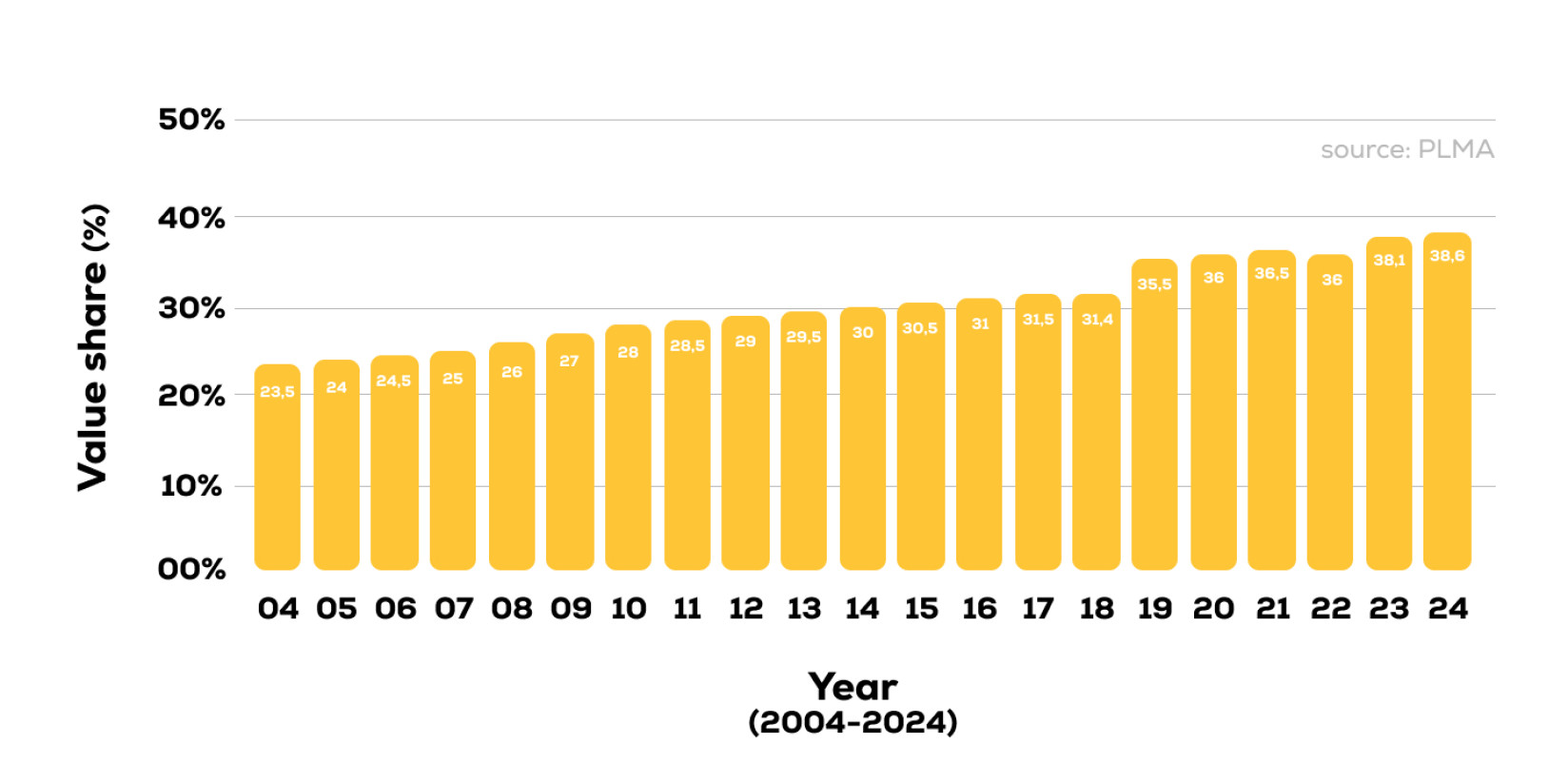

The private label sector in Europe has seen remarkable growth the past 20 years, capturing increasing market share in both volume and value. This trend, which gained momentum during the pandemic, is showing no signs of slowing down. In the first half of 2024, European market value share of private label rose by yet another 0.5% compared to end of 2023, reaching 38.6%. Let’s take a deep dive in what drives this growth, the strategies that enable these brands to close the gap between volume and value share, and what categories and countries lead the charge.

Propelled by the pandemic

The global pandemic certainly acted as a major breakthrough moment for private label brands. Consumers faced economic uncertainty and turned, more than ever, to private label products as they offered good value and quality. Now, the dust has settled and this shift in consumer behavior has persisted: private label continues taking away market share from established brands. According to a PLMA research, 16 of the 17 countries investigated saw an increase in private label value share.

Closing the gap between volume and value

One of the most notable trends is how private label is closing the gap between its volume and value share. This indicates that private label brands are not only selling more products, but are also capturing more value from each sale. Several factors contribute to this additional win for the sector:

Improved quality and perception: outgrowing its perception as the cheaper alternative, private labels have significantly bettered product quality and product branding.

Product innovation and tiering: Customer brands now tend to lead category innovation, whereas they used to mimic A brands in a distant past. Retailers have invested in marketing and category development to improve brand perception, creating their own product tiers.

Strategic pricing: Pricing is no longer the main variable. With quality and quality perception on par with A brands, gone are the days that private label products were on average 40% cheaper. Through the tiered label approach, mid and premium private label brands edge closer to the pricing points of manufacturer brands.

Countries like the Netherlands or Switzerland have excelled in capturing value share. These small gaps between volume and value share may be attributed to the presence of retailers that already have developed the strong tiered approached, with a focus on premium private label products. Recent data also suggests the premium tier —even if still the smallest category—is growing at a faster rate than the mid and discounter tiers.

For instance, Albert Heijn, the market leader in the Netherlands, emphasizes high-quality and premium private label products, while private label makes up 60% of their offering. This strategy has allowed them to price their private label products closer to branded products, thereby capturing more value.

The cool gang is led by frozen

The frozen food category has been a standout performer in the private label sector. The top grower, actually. ‘Perishable and frozen foods’ are accompanied by the categories ‘confectionery & snacks’ and ‘ambient food’. In Portugal and Spain, the value share of private label in frozen food has grown by 2.3%, over 4X the general value share growth of private label.

But why is it so popular in private label?

It’s convenient: People always have a feeling they lack time, and look for convenient solutions to win back some of that time. Frozen foods offer convenience in today’s fast paced world.

It’s good quality: Freezing technologies improve product quality and taste retention, making them more appealing to consumers. This is connected to growing consumer awareness that frozen foods can be just as nutritious than fresh foods.

It’s a good deal: Good quality at a better price point? Yes! These cost-effective brands don’t only appeal to discount customers, but attract other types of retail customers too thanks to its great value perception.

Conclusion

the private label sector in Europe is experiencing overall long-term growth, driven by high quality, innovative and tiered product offerings, and strategic pricing. The frozen food category, in particular, is leading the charge, with significant growth in countries like Portugal and Spain. Customer brands not only are succeeding in growing their volume share, but also increase their value share within almost all markets.